GST Shake-up Proposed: Group of Ministers on GST to recommend a two-slab structure, scrapping the 12% and 28% rates

GST Shake-up Proposed: Group of Ministers on GST to recommend a two-slab structure, scrapping the 12% and 28% rates

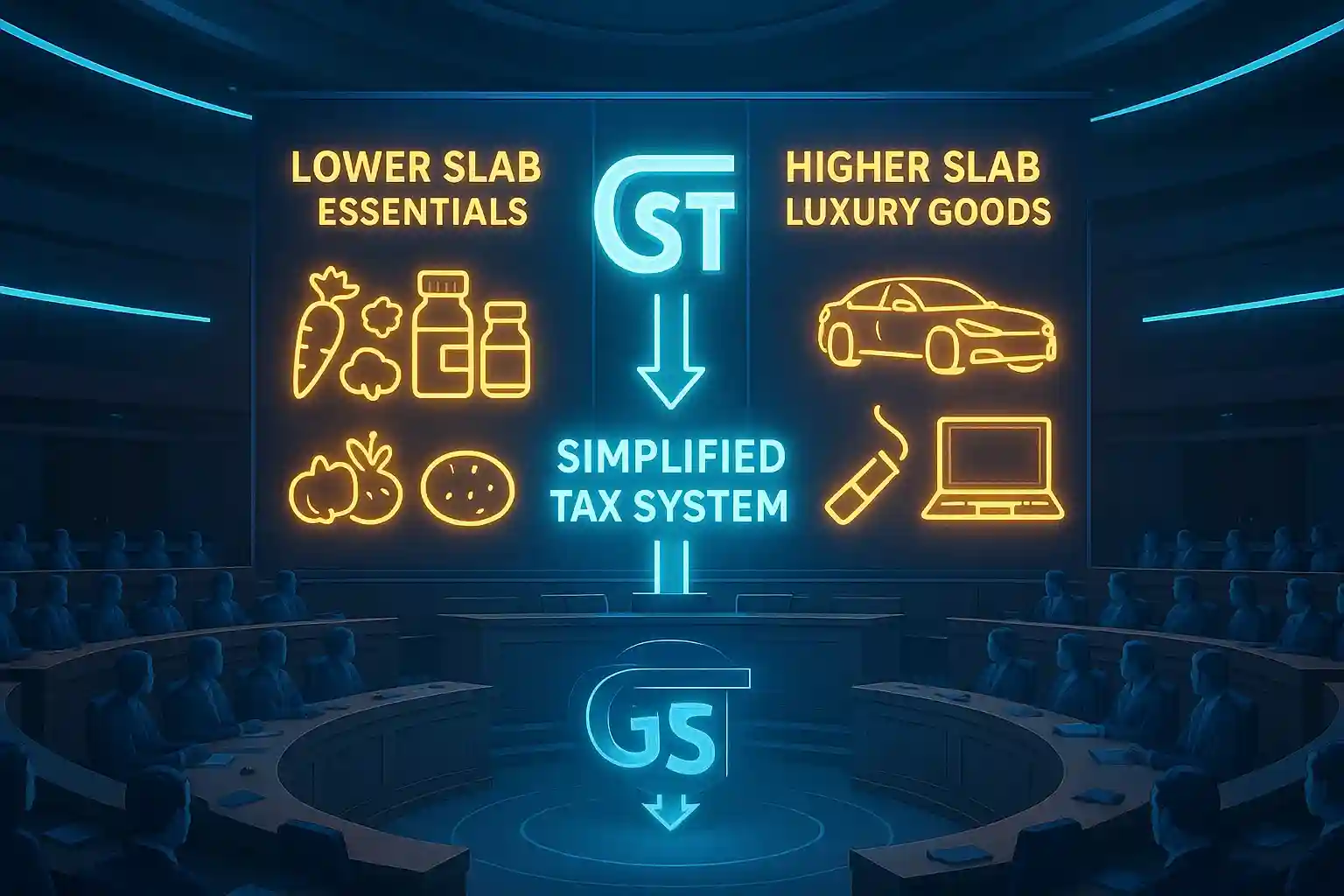

NEW DELHI, India – In a major move aimed at simplifying the country’s Goods and Services Tax (GST) regime, a high-level Group of Ministers (GoM) on GST has finalized its recommendations to the GST Council. The GoM is proposing a radical two-slab structure that would involve scrapping the current 12% and 28% rates and merging them into new, more streamlined tax brackets. This shake-up is expected to be a key agenda item at the next GST Council meeting.

The proposal comes after months of deliberation on how to simplify the current four-tier tax structure (5%, 12%, 18%, and 28%) which has been a source of complexity and litigation. The new two-slab system, if approved, would be one of the most significant overhauls of the GST framework since its inception.

The Proposed Two-Slab Structure

Under the proposed model, the GoM suggests merging the current 12% and 18% GST rates into a single, new rate, potentially in the range of 15% to 16%. This would simplify the tax on a wide array of goods and services, from household items to consumer durables. Meanwhile, the high-end 28% rate on luxury goods and demerit items would also be scrapped, with these products being taxed at a higher, yet-to-be-decided rate, possibly around 30%.

Essential goods and services would continue to be taxed at the lowest 5% rate, while a select few high-value items would attract a new premium rate. This move is aimed at reducing classification disputes and making compliance easier for businesses.

The Rationale and Challenges

The primary rationale behind the proposal is to streamline the tax system and boost revenue. The current multiple-rate structure has led to frequent disputes over which category an item falls into, creating an administrative burden for both tax authorities and businesses. The proposed two-slab system is expected to increase tax buoyancy and reduce litigation, thereby making the tax regime more efficient.

However, the proposal is likely to face a mixed reception. While businesses will welcome the simplification, consumers might see some goods become more expensive. For instance, an item currently taxed at 12% would now fall under the new merged rate, leading to a price increase. The proposal also faces the significant challenge of gaining consensus from all states in the GST Council, as any change in rates will have an impact on their revenue collections.