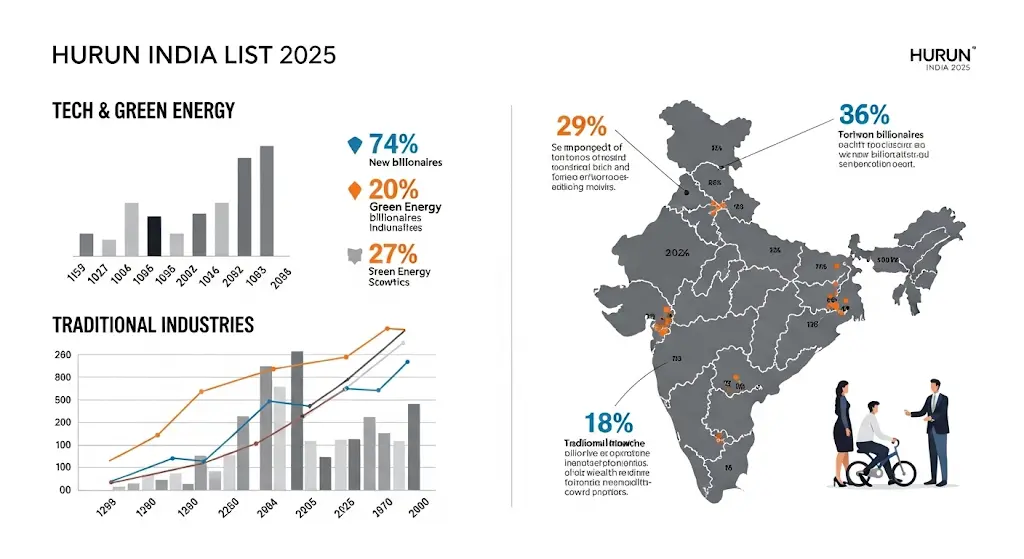

Tech and Green Energy Mint New Billionaires as Traditional Sectors See Slower Growth, Finds Hurun India List 2025

Tech and Green Energy Mint New Billionaires as Traditional Sectors Lag, Hurun India List 2025 Reveals

MUMBAI, India – A tectonic shift is underway in the landscape of Indian wealth, with technology and green energy emerging as the new epicenters for billionaire creation, while traditional industries experience markedly slower growth. The Avendus Wealth Hurun India Rich List 2025, released today, reveals that the new generation of Indian billionaires is being forged in server rooms and solar farms, not just in traditional factory settings.

While the Pharmaceuticals sector continues to host the highest number of individuals on the list with 135 entrants, its dominance is being aggressively challenged. The Technology (IT/SaaS/AI) sector is the story of the year, not only adding the most new faces (45) but also registering the highest jump in cumulative wealth valuation.

The New Wealth Engines: AI and Renewables

The report identifies Artificial Intelligence (AI), Renewable Energy, and the Electric Vehicle (EV) Ecosystem as the fastest-growing sectors for wealth creation in 2025. The cumulative wealth of entrepreneurs in the renewable energy space, for instance, surged by an astonishing 180%, while the valuation of AI-focused companies on the list tripled compared to the previous year.

Key Profiles from the Rising Sectors:

- Rhea Sharma (34), SynthCore AI: A new entrant to the billionaire club, Sharma's company provides AI-driven supply chain and logistics optimization for India's largest e-commerce and manufacturing players. Her net worth skyrocketed to over ₹12,000 crore after a recent funding round valued SynthCore AI at $5 billion.

- Vikram Singh Rathore (42), Surya Renewables: Rathore, a second-generation entrepreneur who pivoted his family's traditional power business into renewables, saw his wealth double to ₹25,000 crore. His company specializes in building decentralized solar grids for industrial parks and has recently expanded into green hydrogen production.

Traditional Sectors Show Modest Growth

In stark contrast, growth in traditional sectors, while stable, has been significantly outpaced. Industries like Chemicals (9% wealth growth), FMCG (12%), and Real Estate (15%) saw only modest gains. While these sectors remain crucial to the economy and are home to many established billionaires, they are not producing new billionaires at the rate of the new-age industries.

"The DNA of Indian wealth is changing before our eyes," said Anas Rahman Junaid, MD and Chief Researcher of Hurun India. "We are moving from an economy dominated by asset-heavy, industrial wealth to one driven by intellectual property, data, and sustainable innovation. The value of a powerful algorithm or a patent in green technology is now outpacing that of a traditional factory."

An industry expert noted that this shift is fueled by both global trends and domestic policy. "The global demand for digital transformation and the universal focus on ESG (Environmental, Social, and Governance) investing are powerful tailwinds," commented Prakash Joshi, Senior Partner at a leading consulting firm. "Combined with India's Production-Linked Incentive (PLI) schemes for electronics, EVs, and green energy, the environment is incredibly fertile for these new sectors to create wealth at an unprecedented speed."

The Hurun list for 2025 makes it clear: India's economic future and its next generation of billionaires will be defined by their ability to innovate in the digital and green economies.