Major GST Overhaul Announced: Council Approves Two-Slab System to Simplify Taxes and Lower Prices on Key Goods

Major GST Overhaul Announced: Council Approves Two-Slab System to Simplify Taxes and Lower Prices on Key Goods

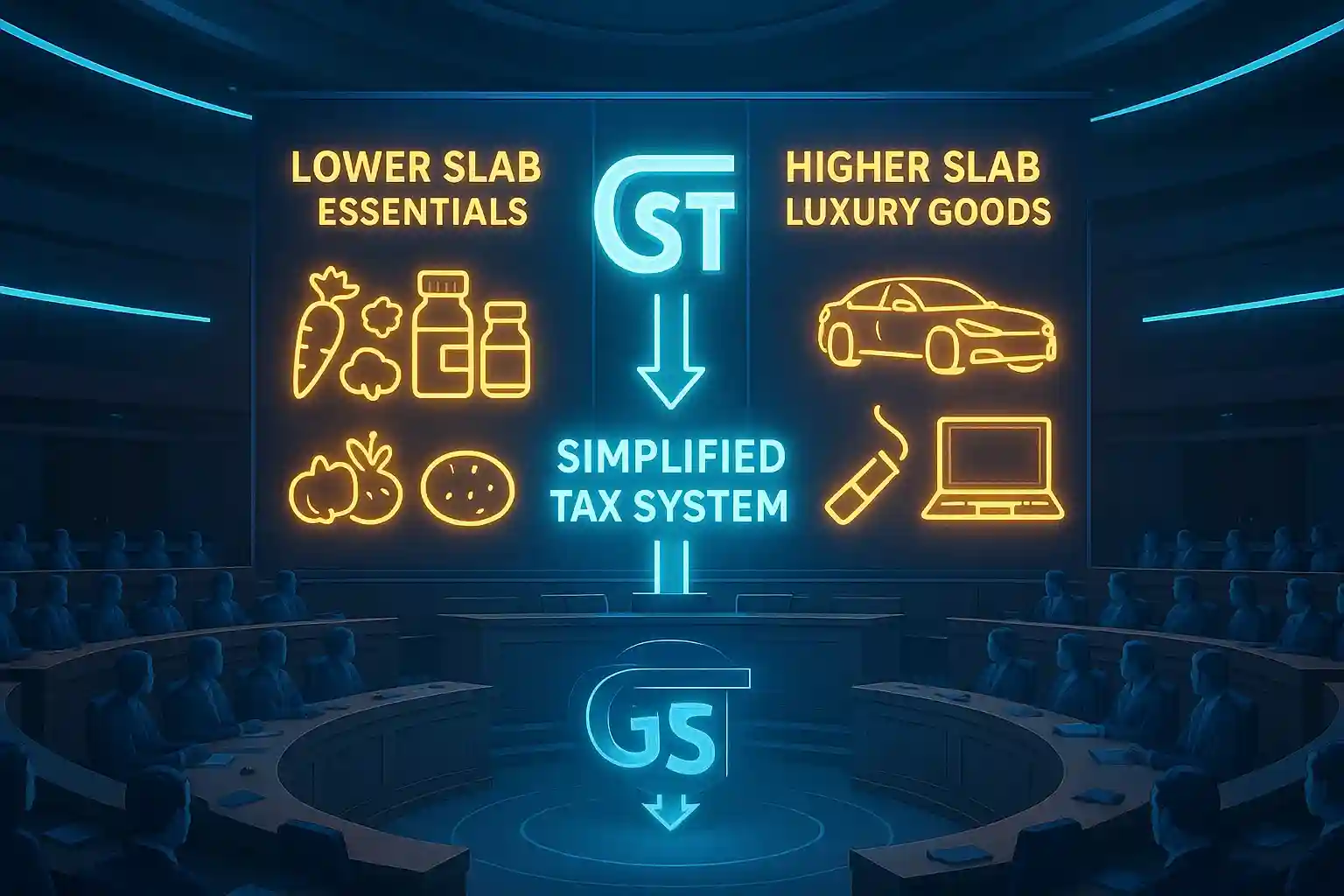

NEW DELHI, India – In a landmark decision, the Goods and Services Tax (GST) Council has approved a major overhaul of the indirect tax regime, reducing the current multiple-slab structure to a simplified two-slab system. The move is expected to reduce tax complexity, bring transparency, and lower prices on a range of essential goods.

The Council, chaired by the Union Finance Minister and comprising state finance ministers, concluded its day-long meeting with consensus on the reform, which is set to take effect from the next financial year.

Key Highlights of the Decision

- The new GST structure will replace the existing four primary slabs (5%, 12%, 18%, 28%) with just two slabs: a lower slab for essential items and a higher slab for luxury and non-essential goods.

- Essential goods such as food items, medicines, and daily-use household products are expected to become cheaper.

- The higher slab will cover items like luxury vehicles, tobacco products, and high-end electronics, keeping revenue streams stable for both Centre and States.

Government’s Position

Union Finance Minister stated, “This reform is a step towards a more efficient and citizen-friendly tax system. It will reduce compliance burden for businesses and bring relief to consumers.”

Officials also confirmed that a detailed rate chart for specific goods and services will be published soon.

Political and Economic Reactions

Industry bodies have welcomed the move, calling it a long-pending demand that will improve ease of doing business. Economists believe the two-slab system will make GST more predictable and encourage consumption.

However, opposition parties have raised concerns about revenue implications for states and demanded greater clarity on compensation mechanisms.

As India prepares for the rollout, the GST overhaul is being seen as one of the most significant tax reforms since the introduction of GST in 2017.