The Price of Oil: How a US Tariff on India is Reshaping Global Energy Markets

The Price of Oil: How a US Tariff on India is Reshaping Global Energy Markets

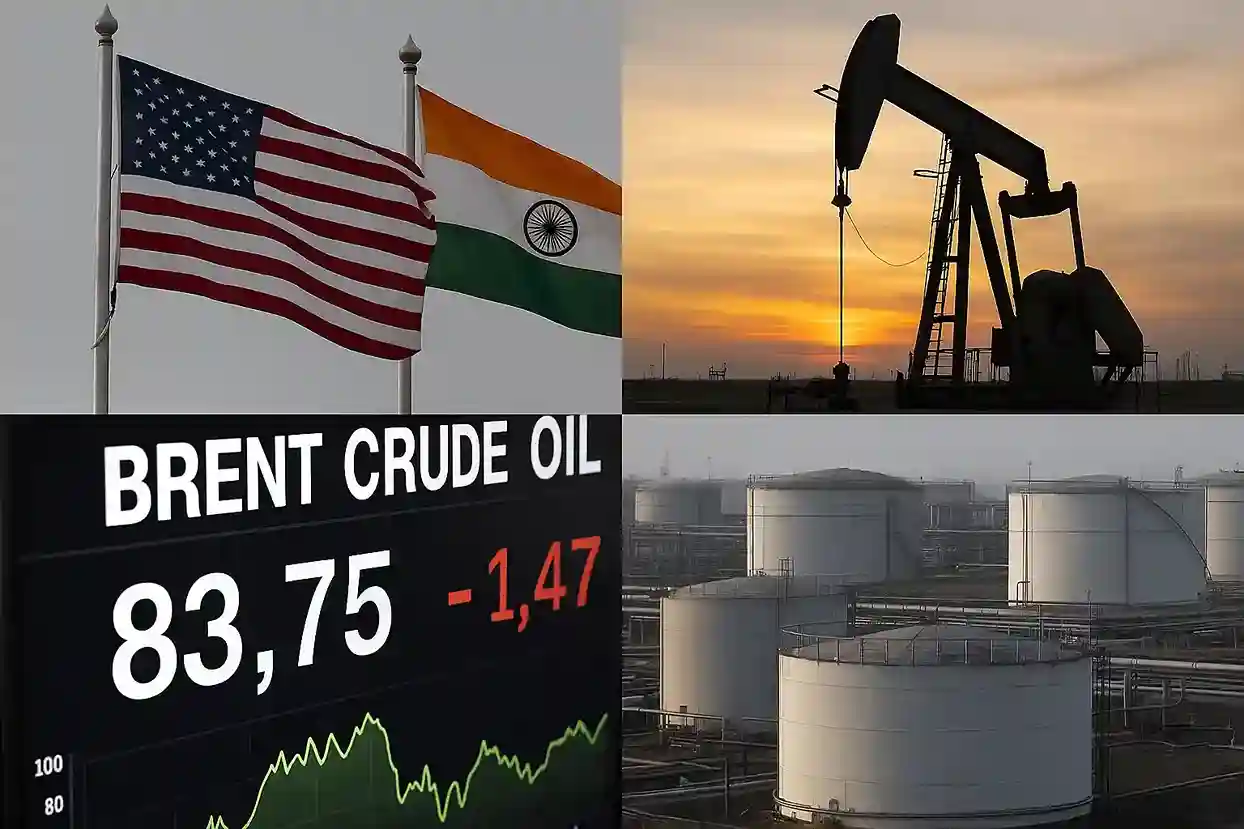

NEW DELHI, India – The United States' imposition of a significant punitive tariff on Indian goods—a direct consequence of New Delhi's continued purchase of Russian crude oil—is being viewed not just as a trade dispute but as a seismic event capable of redrawing the global energy map. While Washington's move is intended to pressure Moscow, its unintended consequence is pushing India, the world's third-largest oil consumer, to accelerate a fundamental shift in how global energy is traded and priced.

The U.S. tariff, which raises the effective duty on Indian goods to a staggering 50%, is a powerful economic tool designed to force India into a geopolitical alignment. However, India's government has publicly stated that its energy security, vital for its 1.4 billion people, remains paramount. Its response is a carefully choreographed strategy to protect its interests and signal a new era of energy diplomacy.

The Economic Catalyst for a New Order

By penalizing India for a strategy that once kept global oil prices from spiraling—buying discounted Russian oil—the U.S. has inadvertently catalyzed a push for a non-dollar-based energy trading system. India, which has already established rupee-based payment mechanisms with Russia, is now expected to expand this model to other key suppliers. The move to de-dollarize a portion of global oil trade, long considered a fringe idea, is gaining serious momentum as a direct response to the weaponization of trade and currency.

This shift is not occurring in a vacuum. Other major energy consumers, wary of similar punitive actions, are watching closely. The prospect of a major economy like India successfully trading oil without relying on the U.S. dollar could encourage other nations in the Global South to explore similar arrangements, fundamentally challenging the petro-dollar system that has underpinned global financial stability for decades.

The Geopolitical Ripple Effect

Beyond economics, the tariffs have significant geopolitical consequences. India is strengthening its energy ties with Russia, Iran, and key Middle Eastern partners while diversifying its sources away from the U.S. This is leading to the formation of new energy corridors and alliances. The result is a more fragmented but resilient global energy market, where no single power can dictate terms.

The U.S. policy, a high-stakes gamble to enforce its foreign policy objectives, appears to be yielding an outcome that runs counter to its long-term strategic interests. Instead of a cohesive front, it is fostering a multipolar energy landscape where countries are increasingly prioritizing national interest and strategic autonomy over compliance with sanctions regimes. For India, this moment of crisis is also an opportunity to solidify its role as a key player in a new, multi-aligned world order.