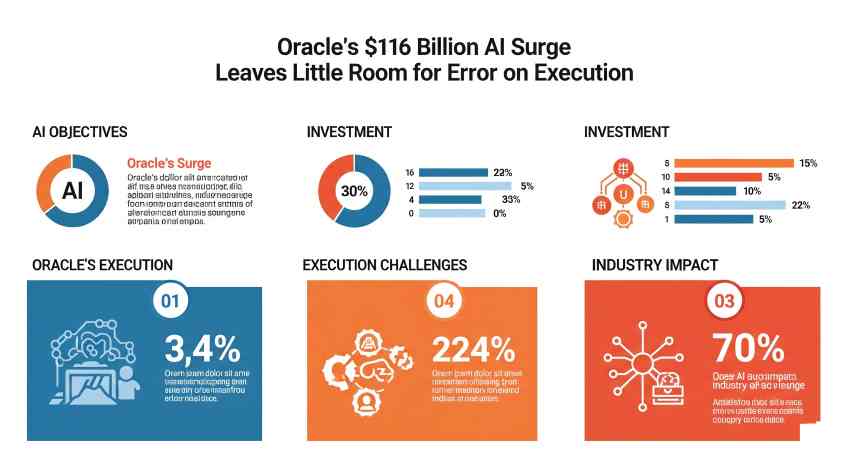

Oracle's $116 Billion AI Surge Leaves Little Room for Error on Execution

REDWOOD CITY, California / NEW DELHI, India – Oracle Corporation (NYSE: ORCL) has recently witnessed an astounding surge in its market capitalization, adding approximately $116 billion in value following its robust fiscal Q4 2025 earnings report released on June 11. This monumental gain, largely attributed to surging demand for its Artificial Intelligence (AI) enabled cloud infrastructure, has propelled the tech giant into a new echelon of valuation. However, analysts warn that this elevated market confidence leaves Oracle with little to no room for error in its ambitious AI strategy.

The company's latest financial results showcased remarkable growth in its Oracle Cloud Infrastructure (OCI), particularly driven by AI workloads. Oracle's remaining performance obligations (RPO) — a key indicator of future revenue from contracted services — soared to $138 billion, up 41% year-over-year. CEO Safra Catz has projected that total cloud growth could exceed 40% in fiscal year 2026, with OCI infrastructure growth potentially surpassing 70%. Oracle's strategic partnerships, including recent collaborations with xAI to host Grok models on OCI, and existing ties with OpenAI, underscore its aggressive push into the generative AI space.

Despite the impressive growth metrics, the market's enthusiastic response has pushed Oracle's stock into what some analysts describe as an "overbought" territory, with its valuation reaching levels not seen in over two decades. The current price-to-earnings (P/E) ratio stands significantly higher than its historical average, reflecting immense future expectations already priced into the stock.

"The market has given Oracle an unequivocal vote of confidence, essentially betting heavily on its ability to become a dominant player in the AI infrastructure landscape," commented a tech industry analyst based in New York. "While the vision and current growth are compelling, this also means the company faces unprecedented pressure to execute flawlessly. Any slowdown in OCI expansion, hiccups in AI platform delivery, or even minor misses on future guidance could trigger a significant correction."

Oracle's aggressive capital expenditures to build out its data center capacity (planning to double by 2025 with dozens of new multi-cloud data centers underway) further highlight the high-stakes nature of its AI gamble. The coming quarters will be critical in determining whether Oracle can meet the sky-high expectations now embedded in its $600+ billion valuation.